Please open your brokerage account and place a manual sell order on the stocks hitting the circuit.

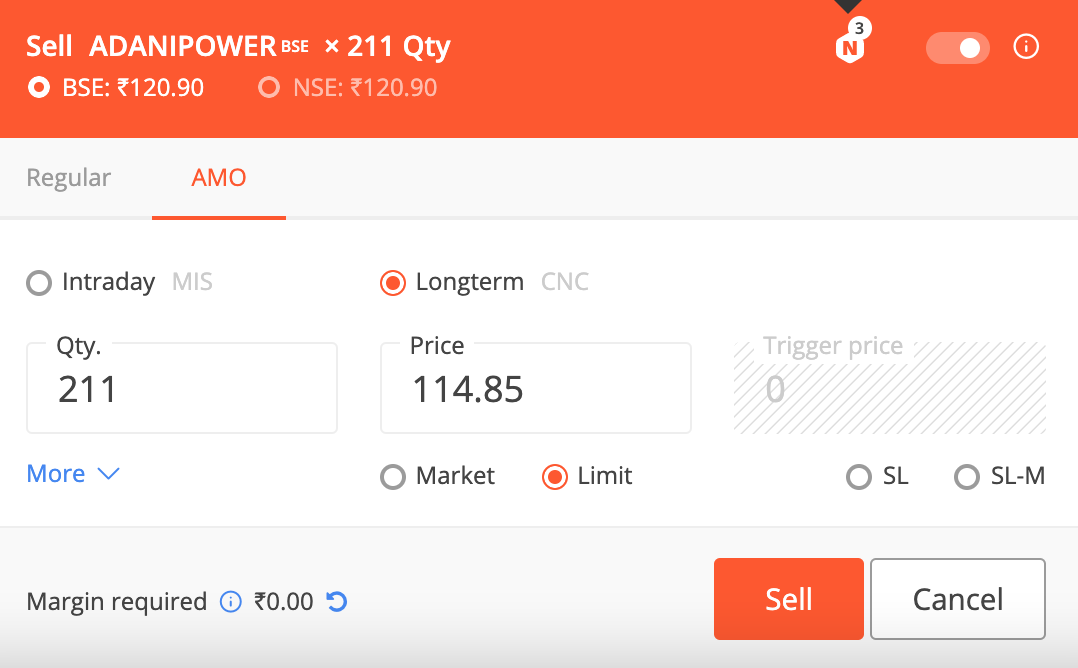

Here's an example for using Zerodha, the same process for other brokerage accounts.

After Market Order

You can send an after-market order (AMO) to sell at -5% of the current last price. We use an after-market order because it will get the highest priority the next day. On the exchange, the order that comes first gets the first exit.

Good Till Cancel Order

The second option is to use a GTT/GTC order. Fill in the details to sell all the stocks hitting the circuit in your account that you'll find in the holdings tab.

This will be open till it gets executed. The best idea is to place the GTT order at 5% below the current price.

In the screenshot you'll see the last price is 120.9, I put the order for 114.9 (5% below) and used 118 as trigger price so that tomorrow morning it has the highest time priority when the market opens and it executes quickly. Make sure that you put the quantity right and choose the SELL option.

Tomorrow if the circuit is again hit without execution, you'll have to change the price to lower. The earliest you replace the price of the order the better chance for execution.